Updated July 2022

Ah, the Permanent Change of Station, or “PCS Move” — military families all around the world are familiar with what comes after they hear those words: a house full of moving boxes, detailed inventories of family heirlooms, and road trips to new homes.

A PCS is the standard military term for an official relocation to a new military installation, but there are multiple types of PCS moves. And they can sometimes give you some wiggle room to gain some money whenever the government isn’t picking up the bill.

After going through four different military moves myself, here are the nitty-gritty details everyone going through this should know about their moving options, shipping and storage, and how to save a lot of money.

Types of Military Moves

The US Department of Defense is adept at handling the logistics of moving service members and their families all over the country and internationally. Most occur with six months or more notice, but it is not unheard of to need to relocate on short notice to fill a critical position.

And in many cases, military members are able to choose how to ship their household items. Here are the two most common types of military moves.

Household Goods Move (HHG)

For those looking to put in the least amount of work themselves, a Full-Service household goods move may be the option assigned to you.

During an HHG move, the Department of Defense finds, contracts, and pays for all move-related services and expenses. This is done through local moving companies as well as larger group contracts. The service member has no input into which company packs or transports their things.

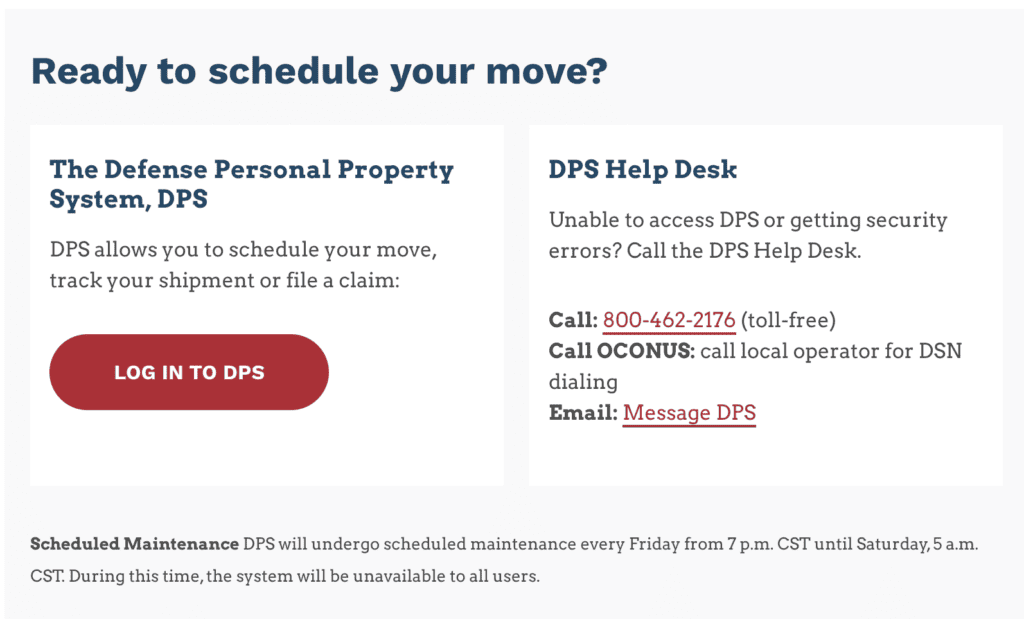

Once the service member initiates the move by contacting their local Housing Office or using the online Defense Personal Property System (DPS) at www.move.mil, everything is taken care of without anything required of the military member, beyond scheduling the pack out and delivery dates.

An HHG move is almost always required for those moving overseas, including to or from Alaska or Hawaii.

Worried about precious items being lost or broken? While the contracted moving companies have strict packing guidelines to follow, DPS provides a claims process to reimburse service members for things that don’t make it to their new destination in one piece (or at all). But you do have to submit photos and replacement values on the claims form provided by the moving company for reimbursement.

Personally Procured Move (PPM/DITY)

A Personally Procured Move (PPM) — formerly called a do-it-yourself or “DITY move” — is a favorite among experienced military members and their families.

Why?

Because, for a little bit of extra effort and logistics coordination, the service member can actually profit from their relocation with a PPM.

Keep in mind that PPM/DITY moves are predominately for moving within the United States.

Those opting for a PPM will have to pack, transport, and then unpack their household items at their new home. For PPM Moves, the military reimburses up to 95% of the cost that it would have required for a Full-Service move. The member is able to keep the difference. The amount does vary based on rank, and while it can be estimated using PPM entitlement calculators, it’s best to check with your local transportation office for exact numbers.

“…the average military family moves three times as much as non-military ones, which is about once every two years. Children in these families can expect to move six to nine times during their K-12 school years.”

The items eligible for reimbursement are based on weight, and sometimes this is referred to as “Household Good Weight Shipping Allowance”, or “HHG”. Again, keep in mind higher-ranking service members have a higher weight allowance, since they typically have larger households.

How do I get reimbursed for a PPM/DITY move?

To go through the process of reimbursement, make sure to get an empty truck weight ticket at your origin, then full truck weight tickets at your origin and final destinations.

(Curious about dislocation allowance and other PCS allowances? Click here.)

How can I save the most money with a PPM/DITY move?

It’s tempting to do the labor for your entire move on your own to save the most amount of money, but finding affordable and efficient movers — especially for just the labor — isn’t as expensive these days!

By shopping around for a good deal for local movers, the military member can still pocket the difference between the reimbursement and the actual costs. Even with movers, this can amount to thousands of dollars in profit for those opting to pack, unpack, and transport themselves.

See prices for movers by the hour – instantly.

Read real customer reviews.

Easily book your help online.

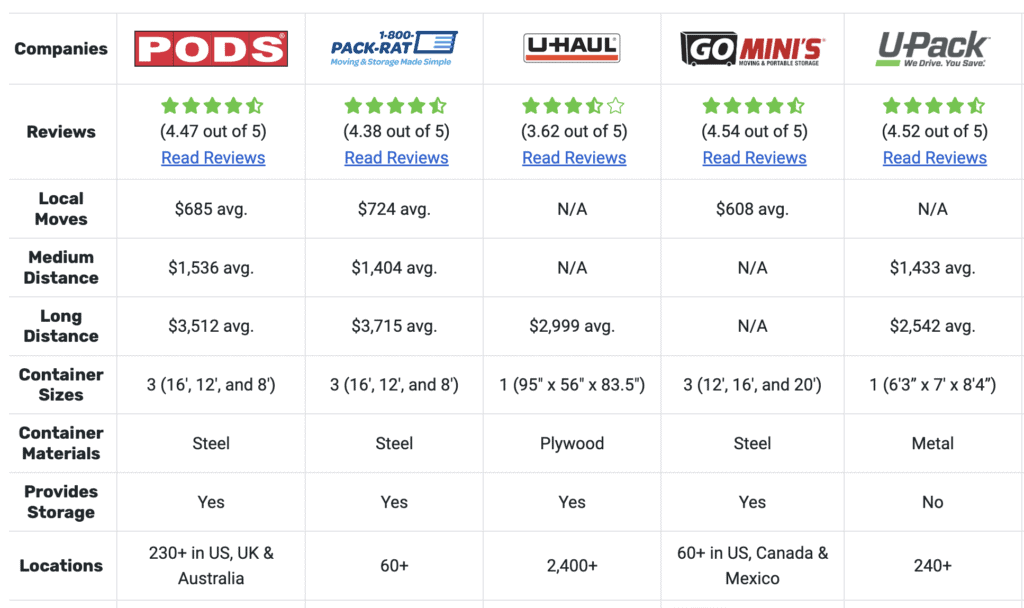

PPMs and PODS (and other shipping containers)

Not sure if you are up for the challenge of driving a big moving truck across the country by yourself?

Shipping containers are a great solution for getting your things transported for you, especially when you need a flexible window of time.

You can rent a PODS container, or any other portable storage container available in your area. Your container will be delivered to you, then picked up and shipped to your new destination when it’s ready.

Just like any other moving expense, you pay for the service and are reimbursed later for what it would have cost the military to do the job as part of a Full-Service move.

You can still hire professionals to take care of any step of the moving process — packing or unpacking, transportation, and shipment — and you’ll still likely save some money from the reimbursement amount provided by the Department of Defense.

Military Moving FAQ

You may have heard a lot of strange military terms floating around out there. Don’t worry, I was once confused as to what they all meant too!

Here is a 101 (or a quick refresher course) on some of the most important things you need to know for military moving. And if there’s anything you still have questions about, the DPS has extensive resources to help you learn everything you need to about your move.

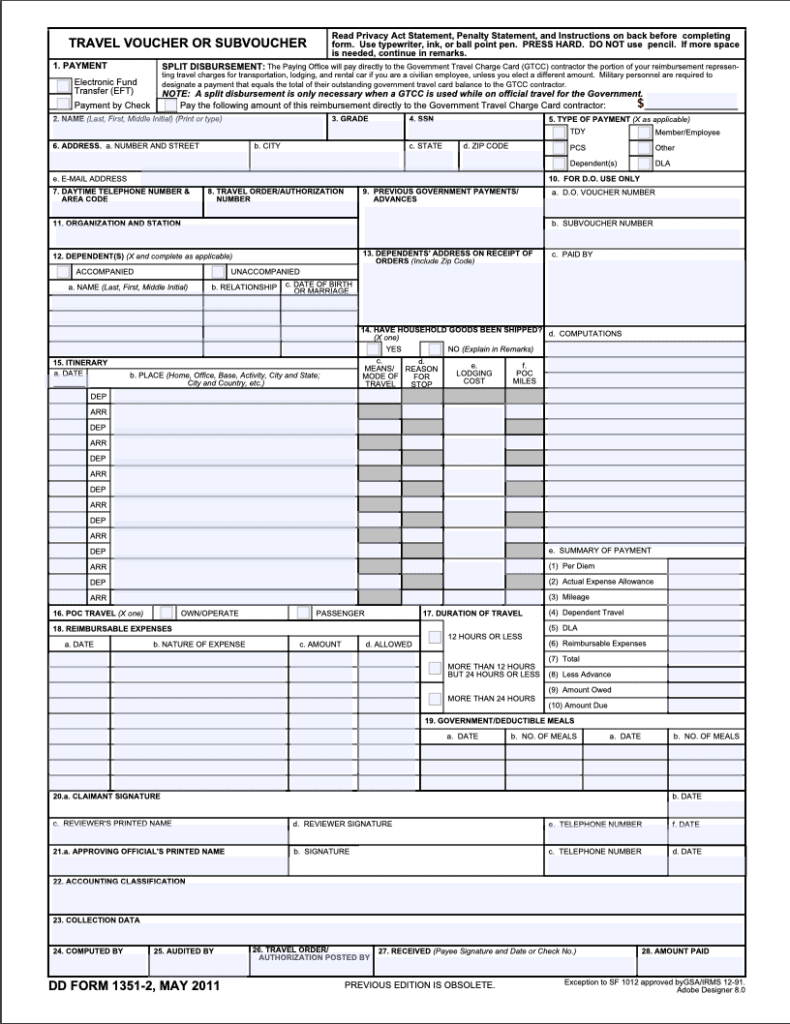

How do I get my PCS allowances while moving, such as dislocation allowance for meals?

There’s the process of moving, then there’s all the other important stuff surrounding a move.

If you are curious about how to get reimbursed for things like meals, hotels, Airbnbs, car mileage, and more, here is a fantastic write-up on what the military calls per diem allowance, temporary lodging expense (TLE), and travel by privately owned conveyance (POC), as well as all the important forms you will need.

What is “Unaccompanied Baggage“?

The Department of Defense allows for a small shipment to be sent in advance of the bulk of your move, and this is often referred to as “unaccompanied baggage”. This small shipment usually consists of clothes, bedding, and some household items that the family will need immediately when they arrive. This is done to avoid any arrival window mishaps.

“A PCS is the standard military term for an official relocation to a new military installation, but there are multiple types of PCS moves. And they can sometimes give you some wiggle room to gain some money whenever the government isn’t picking up the bill.”

Does the military cover dependents traveling with me?

Yes! However, the amount depends on how they travel.

If you all are traveling by car (POC), the standard rate for mileage is $0.22/mile. This also applies to your own travel!

If they are traveling by plane, bus, or train inside the US, it’s up to your personal military advisor to authorize their travel and reimburse you for the cost of the ticket(s).

And if they are traveling outside the US, they typically will be booked a ticket on a military aircraft. Although, sometimes you might be asked to take a commercial flight with reimbursement in the case that no American-Flag carrier aircraft is going to that location.

What is “Professional Gear”?

What about all of the extra uniforms, equipment, and professional materials that military members need to do their jobs? For both a Full-Service HHG move or a PPM/DITY move, the stuff you need for your job is considered “pro gear” and does not count against the overall weight allowance and is annotated separately.

Professional gear is defined as:

- Uniforms

- Medals, Ribbons, Rank insignia

- Ceremonial uniform items (e.g. sword or saber)

- Job-specific equipment (e.g. fins and masks for military divers)

- Training manuals, required reading

What is “Non-Temporary Storage“?

Once you arrive at your new home, all that’s left to do is unpack, right? Well, usually the answer is yes, but what if a military member faces a prolonged time away from permanent housing and is staying in a hotel room?

This is where the government can hold on to your things for you, and it’s called “Non-Temporary Storage”. Non-Temporary Storage may be authorized for your household items in this case.

Non-temporary storage is most commonly used for those moving overseas where housing may be limited or significantly smaller than in the US. It can be authorized in some cases for moves within the US, however.

“For PPM Moves, the military reimburses up to 95% of the cost that it would have required for a Full-Service move. The member is able to keep the difference.”

How often will I be moving in the military?

Military moves do not follow a set rotation and vary from service to service. Even within one branch, relocation can be based on a service member’s job specialty, rank, and even personal circumstances, such as the need to fill a gap at another command.

That said, according to the Department of Defense Education Activity, the average military family moves three times as much as non-military ones, which is about once every two years. Children in these families can expect to move six to nine times during their K-12 school years. That’s a lot of moves during a 20-year military career!

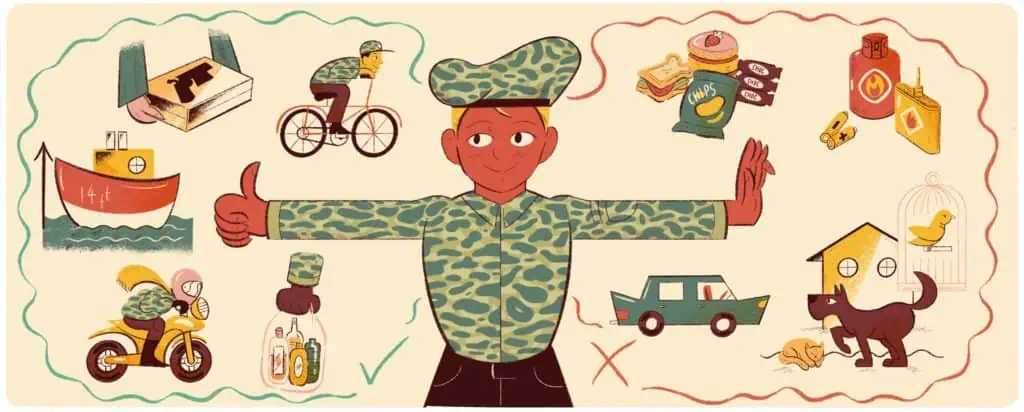

Is There Anything the Military Won’t Pay to Move?

The military will move many household items that you may expect — furniture, clothes, bedding, and kitchen items. But a few unexpected items are also on the approved list. Yep, there is an “approved list”!

Before purging your home (or buying a new, fancy toy), make sure that you know if the military will move it or if you will have to arrange transportation at your own cost.

What will the military move?

- Firearms: Provided that you have the required documentation and follow the local laws at all points in transit, the military will pay to ship personal firearms

- Unopened liquids: Bottles of unopened liquids, including alcohol, are usually allowed in the shipment

- Bicycles: Bicycles are allowed and included in the overall shipment. The same applies to larger house maintenance items, such as lawn mowers and weed eaters

- (Some) boats: Recreational boats under 14 feet may be shipped, but do count against the overall allowed weight. For this reason, it can sometimes fall on the member to pay for their own shipment

- Recreational vehicles: Motorcycles and dirt bikes are allowed as part of the shipment within the US. When moving overseas, motorcycles and dirt bikes follow the same guidelines as cars. RVs are authorized on a case-by-case basis

What won’t the military move?

- Cars: In general, the military will pay to ship one (1) vehicle overseas, but expects members to transport their own vehicle to their new home within the US. You may be able to be reimbursed for gas and expenses, however, depending on your specific situation

- Consumable items: Items that are meant to be eaten are generally not allowed

- Pets: Transportation of pets is done at the member’s expense. It is important to check local regulations at your new home as they may require proof of vaccination or a quarantine period

- Flammable items: Understandably, moving companies require that all flammable liquids be drained from gas tanks. Batteries are also normally not moved as part of the overall shipment

Moving is almost inevitable in military life. Whether you want to use a Full-Service option that takes care of all details or you put in some effort to make some extra spending money, there is an option for you out there. Knowing the terms ahead of time, as well as what you can and can’t move, will make moving day that much smoother. You’ll be on your way to your new home and a new adventure in no time!

A small-town Missouri native, Katie writes about parenting, military families and travel for a variety of regional and national publications. Her work has appeared in At Ease Magazine, Legacy Magazine, and Monterey Bay Parent Magazine, where she was a monthly columnist. She is a graduate of the United States Naval Academy with a degree in English and has a Master’s Degree in Education from Johns Hopkins University. Connect with Katie @kmbegley or at katiemelynnbegley.com.

Illustrations by Robbie Cathro