They say that if you do what you love, you’ll never work a day in your life. Okay, but what if your dream position exists at a company that’s hundreds – even thousands – of miles away from where you live?

As of 2018, about 10% of U.S. job seekers chose to relocate for work. Moving long-distance can be particularly tough, especially if you’re not prepared for the financial and logistical requirements. So if you’re thinking about moving cross-country for a job, here’s what you should know first.

Are in-office jobs coming back?

Though remote work has been growing, especially in light of the pandemic, it is inescapable that a segment of the population will always need to work in person. Experts describe the current landscape as shifted, not irreversibly changed.

“Many employers are saying that they are willing to provide flexibility to work remotely some days of the week, but also will expect you to be in office some days for various reasons,” says Diane Farrell, director of career services at the University of North Georgia.

Some of those reasons include establishing company culture and fostering collaboration, which isn’t quite the same over Zoom. “Therefore, relocation is still expected for many in-office job candidates.” No matter how much the world changes, this is still going to be a hurdle for a lot of people.

Seriously consider whether moving cross-country for work is for you

But before getting into the nitty-gritty details of moving across the country for a job, the first step is to think carefully about whether that’s the right choice for you and your family. Packing up your life and restarting it thousands of miles away is something worth considering carefully.

But there are plenty of advantages to moving out of state for a new job. “If the opportunity is amazing and not something you would be able to do in your current location (such as working on Wall Street, which is only in Manhattan), then that’s a pro for sure,” tells us Vicki Salemi, Monster.com career expert.

And don’t discount the effect of a new environment and new people. “A change of scenery and new energy may be an invigorating addition to this new job,” Salemi says. It’s cliche, but a fresh start in a new city may be just what you need to get motivated and climb the career ladder.

On the other hand, there are a ton of steps involved in moving long-distance that are easy to forget. You have to transfer your utilities, update your license and car registration, get your kids’ school records moved, find a new dentist—the list goes on. Oh, and you also have to impress your new boss and stay on top of your new job responsibilities while getting settled in your new home.

How much does moving for a job cost?

An interstate household move costs between $3,500 -$6,000 on average, depending on who you choose to move you.

Moving cross-country for a job definitely requires some time and money. But for the right position, it can be well worth it. The key is to plan for the costs and find ways to save anywhere possible, including trying to get your new employer to pay for some of that (more on that later).

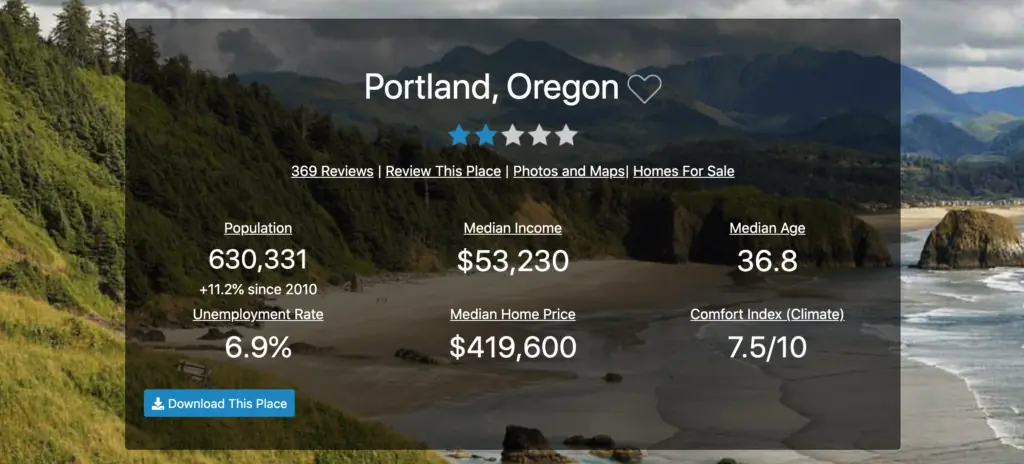

Use websites to do the math on living in a new city

One of the big questions about job relocation is whether you’ll end up in a city that’s more or less expensive to live in than your previous town. “You’ll need to adjust to a new lifestyle, and in some instances, that may be a hardship,” Salemi says. For instance, if you land a job that’s in a major city, but you’ve been living in the suburbs, you might have to pay more for your mortgage or rent, or settle for a smaller place.

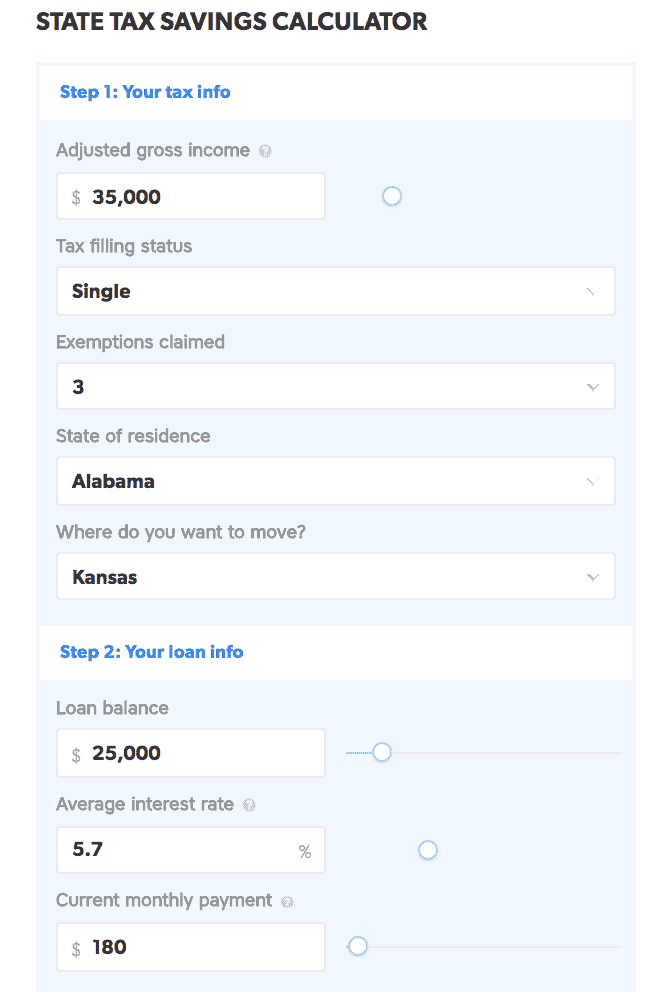

Taxes are one component of cost of living (COL) that can have a big impact on your budget. “If you’re moving from a state with no state taxes into one with high taxes, while it won’t impact your compensation, it will net a lower amount direct-deposited into your bank account,” Salemi says.

The opposite holds true, too. Moving to a state with no income tax (Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming) or no sales tax (Alaska, Delaware, Montana, New Hampshire, Oregon) could save you thousands of dollars per year. That’s an important factor to weigh when evaluating your overall compensation package.

“An interstate household move costs between $3,500 -$6,000 on average, depending on who you choose to move you.”

Another COL factor you may not consider until it’s too late is insurance. Depending on the state you move to, you may have to find new auto, home, and health insurance. You may end up with higher premiums and even a lapse in coverage if you don’t plan for it prior to the move. “Changing health insurance may leave you with a gap. Consider how you can stay covered…talk to HR,” Farrell says.

A site with comparative tools, like BestPlaces.net, can be a useful resource for comparing where you live to where you plan to move. You can compare factors such as housing costs, healthcare, utilities and more to see how local expenses measure up against what you’re used to spending.

Never ever be afraid to leverage cost of living in your negotiations

Once you have an idea of what the cost of living is in your new job’s city, compare that to your salary and benefits package. “Cost of living factors into how salary is determined, so when you’re moving to another state, determine how you’ll be impacted, whether higher or lower, and that can help you determine if this salary is equitable with the new location,” Salemi says.

If your compensation seems to fall short, use that COL data, as well as personal characteristics such as industry, skill level, and experience to negotiate a better package. And yes, you should always – virtually without exception – negotiate your salary.

Even if you can’t get your employer to budge much on the actual salary, there are ways to account for the cost of living beyond your paycheck. According to Salemi, some factors to negotiate outside of salary include:

- Sign-on bonus

- Relocation Bonus

- Additional paid time off

- Additional days working from home

Consider living outside your new job’s ZIP Code (this is attractive to recruiters)

Just because your job is located in a swanky part of the city doesn’t mean you actually have to live there. If cost of living is going to be a roadblock for accepting a new job, seriously consider moving to a more affordable neighboring town to your new job. Doing so could also help you land a job if you’re competing for a role in a major metropolitan area.

“When I recruited positions for NYC, I always received countless resumes. Competition was tight,” Salemi says. “However, when I recruited positions for Stamford and Short Hills, both 45 minutes from the NYC office, I received only a handful of applications. Candidates who applied to positions outside NYC had more of a chance of not only getting interviewed, but getting hired.”

So if you’re looking to relocate to another state for a job, research the office locations and surrounding neighborhoods. “Keep an open mind to pursue both your dream location as well as nearby one that may get less interest in and therefore, less competition,” Salemi says.

Always ask about a company’s relocation assistance

Once you considered the implications of moving to another state, it’s time to talk about the long-distance moving process. If you’re moving for a job, your employer may offer you some sort of relocation assistance. Not all do, but your chances are better if you’re moving into a high-level or specialized position, recruiters say.

“The offering of a relocation package depends on the level of the position you are seeking and or how difficult it is to find candidates that are qualified in the local area,” Diane Farrell suggests.

She explains that relocation packages are relatively common for director or manager level roles and above, depending on the industry. “The higher the position, the more likely they will offer a relocation package,” she says. Even so, certain fields like technology and engineering tend to offer relocation assistance to all levels of employees, since their roles are often highly specialized.

What’s in a relocation package, exactly?

If an employer does offer relocation assistance, it can come in a couple different forms. Some companies offer a flat amount to cover your moving expenses, anywhere from $5,000 to $20,000 is possible, according to Salemi. Others will offer to reimburse receipts from a moving company.

As far as what’s covered by a relocation package, there are a number of expenses that could qualify. Here’s a closer look at what you could get covered or reimbursed:

Professional packing and unpacking: Whether you decide to hire a full moving company or just professional packers to help you load up your moving truck, your relocation package will likely cover some or all of the cost. That includes packing up your belongings and then unpacking once you get to your destination.

Moving supplies: From boxes to tape to bubble wrap, the costs of supplies can add up. A relocation package will likely include some budget for these types of packing materials.

Moving container: If you decide to go more of the DIY route, you may decide to pack your belongings in a moving container rather than hiring a full-service moving company. If that’s the case, your new employer may cover some or all of the cost to hire a moving container company.

Home sale: If you currently own your home, you’ll have to sell in order to move cross-country. Your relocation package could cover a variety of costs associated with that, such as the cost of listing your home to assisting with any losses you incur from selling quickly.

Lease-breaking fee: On the other hand, if you’re a renter, you may get reimbursed for any penalties paid for having to break your lease early.

House hunting: It’s not unusual for a relocation package to include some budget to send you house hunting in the new destination at least once. That may include transportation, lodging, meals, child care, and more.

Closing costs: If you end up buying a house in your new destination, your relocation package may cover closing costs and other associated fees.

Storage: You could end up in a temporary housing situation as you wait to secure an apartment or buy a home. In the meantime, you might have to store some of your belongings in storage until you lock down a lease. Relocation packages often cover this type of expense, whether it’s a storage facility or container that sits on your property until it’s ready to be unloaded.

Transportation: If you end up driving cross-country for your new job, your relocation package may include reimbursement for gas and other expenses incurred on the road. If you need to fly, you could get reimbursed for plane tickets and even shipping your car. Hotels and meals while on the road could also be included.

Keep in mind that every relocation package is different. It could include all of these costs and then some, or only a portion of these expenses. When talking to your future employer about relocation and compensation, you should ask to have any major expenses that are pertinent to your situation covered. You may be able to negotiate a better package than you originally received.

Moving far away?

Do it cheaper.

HireAHelper.com can save up to 40%, compared to traditional interstate moving companies. Click here to learn how.

Budget ahead of time for what your employer won’t cover

Now that you have an idea of how much it costs to live in your new city compared to your old one, plus you know how much your future employer is willing to compensate you, it’s time to figure out how much the actual move will cost. Do this as far ahead of time as possible, because you’ll likely need a couple of months or more to save up, EVEN if your employer is helping.

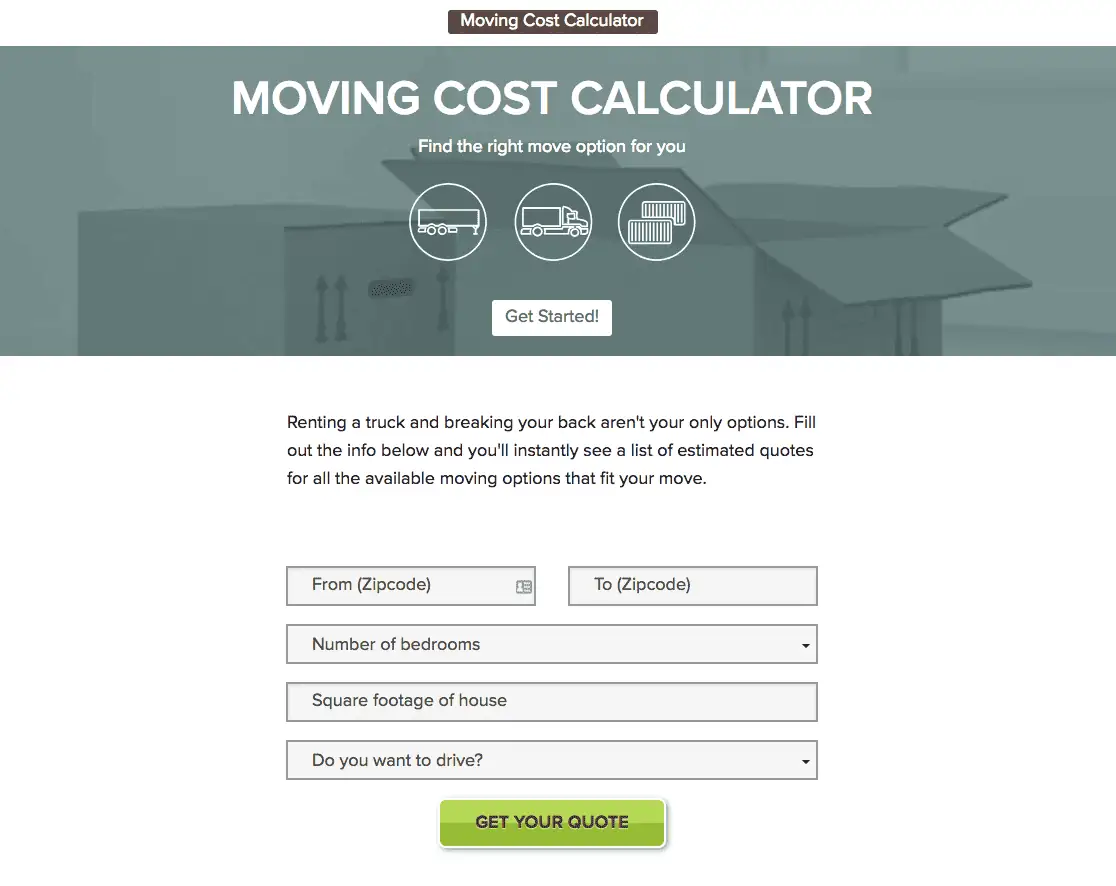

Moving costs will vary widely depending on where you’re going and which expenses will be covered by your employer. At the very least, you should set aside some funds to pay for the actual move.

Know your moving options

When it comes to moving your belongings (aside from doing it all with your own bare hands), experts suggest you have three main possibilities:

- Hire professional movers: If you want to go the full-service route, hiring a professional moving company is your best bet. They will pack up your belongings, load them on the truck, and unpack everything for you. Though it’s more convenient, this option is also generally the most expensive. It can cost anywhere from $1,200 to $5,000 (or more), on average, to hire movers for a long-distance move, according to Consumer Affairs. The cost will largely depend on the size of your home (i.e., how much stuff needs to be moved) and how far you’re moving

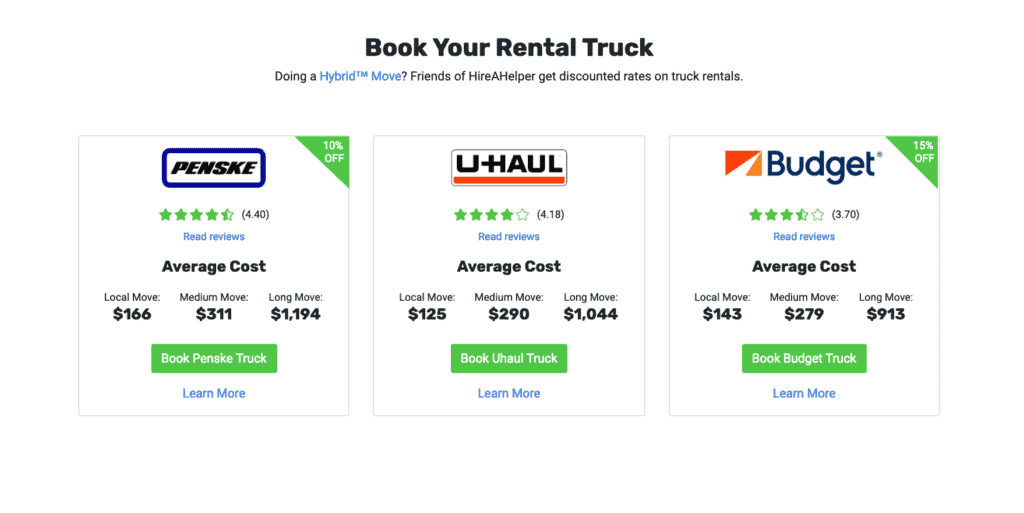

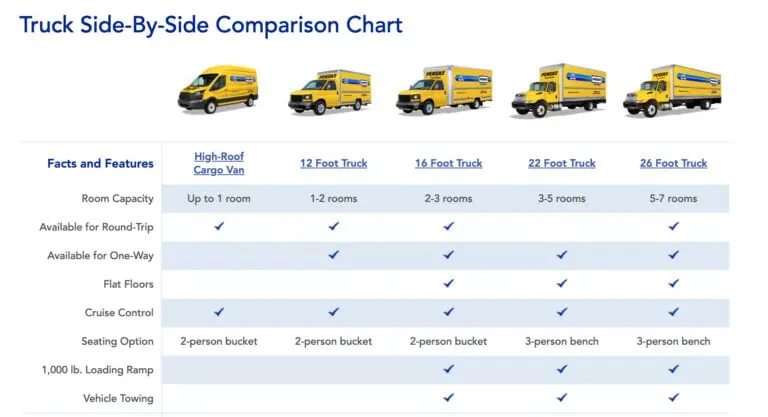

- Rent your own moving truck: If you want to be in control of the moving process from beginning to end, you might want to rent a moving truck. You will do the transporting yourself, but you can hire movers to do loading and unloading to save money over a full-service move. To move about 1,000 miles, a truck rental costs around $533 for a 16-foot truck (which can handle about 2-3 bedrooms), plus gas and surcharges. If you want to upgrade to a 26-foot truck, you’ll pay around $823 or more

- Use a shipping container: The nice thing about using a shipping container (aka a “moving container”) is that you can take your time packing up! Once you’re ready, the moving container company will pick it up and drop it off at your destination. Then you have some more time to unpack at your leisure. If you need extra time unpacking, it doubles as storage (for an added fee). Shipping containers are a good combo of DIY packing with professional drivers. This option tends to cost around $2,000 to $3,000 for a long-distance move, with storage included

Finally, don’t forget about moving supply costs! Between packing tape, bubble wrap, labels, sharpies, and other miscellaneous packing supplies, you might need to spend a few hundred dollars ensuring your belongings are safe and secure. For example, supplies to move a one-bedroom apartment cost around $69-$90. A two-bedroom home will run closer to $178-$197, and the costs increase from there. (If you get movers, oftentimes they will cover the cost of most if not all of these things.)

If you need some help with the savings side of things for all this stuff, a budgeting app such as Mint or You Need A Budget can help. These tools allow you to set savings goals and track your progress way ahead of your move.

What if I don’t have a job lined up yet?

Moving across the country for a job offer is one thing. But what if you want to move somewhere for better job opportunities, but don’t actually have anything lined up yet?

This is a matter of personal preference and risk tolerance, so it’s not a one-size-fits-all approach, all the experts suggest. It definitely helps if you have family or friends you can stay with until you land a job, and in the meantime be able to network locally and adjust to the new environment. When you score that job, you won’t have to adjust to everything all at once and can focus on the new job.

“Candidates who applied to positions outside NYC had more of a chance of not only getting interviewed, but getting hired.”

– Vicki Salemi, Monster.com career expert

“Other people may feel more comfortable networking remotely and interviewing from their current location, then moving once they secure the offer of employment,” Salemi suggests. It really comes down to financials, what you’re most comfortable with, and where you can conduct the most productive job search.

(If you’re staying with your sister who has four kids and three dogs, finding a quiet space to conduct Zoom interviews may be challenging.)

How to start the process of looking for a new job in a new city

Get a current snapshot of the job market: It’s a good idea to do extensive research on the area you’re relocating to. Is it exploding? Shrinking? Which industries are hot? Keep this in mind, because you may not want to stay in this new job forever. “Ensure you’re moving to a location with viable opportunities beyond the one right in front of you,” Salemi streses.

Visit, do some recon: If possible, visit the new city before you make your decision to move. Photos and virtual tours just don’t tell the whole story. “If you can’t visit, use your network to see if someone you know has friends or family in that area,” Farrell says. “Arrange to talk with them about what they like about living there and any drawbacks to the area.”

Network (virtually) ahead of time: Start reaching out to locals in your industry who could be potential referrals to gigs in the area. “Use LinkedIn to find people in your field who are working in that region. Reach out to connect and see if they are willing to talk,” Farrell says.

Save up: Moving without a job lined up is a risky move, especially because you don’t actually know how long it’ll take to secure a position and start earning a paycheck. Aside from the budgeting you’re already doing for the move, you should have a few extra months’ worth of expenses saved up to float you until you get hired. “If you are renting, most property owners want to see you have employment before they will rent to you, so you need to consider where you will stay if you move before landing the job,” Farrell says.

Create an out for your current place: If you currently own a home, timing can be tricky. Consider the housing market in your current area and price it to make sure it sells – a good real estate agent can help. If you plan to buy in the next location, begin looking well in advance. “Consider whether there will be a lag between when you arrive and when you can move into your new residence. You may need to investigate local hotels or other interim housing if you expect to experience a gap,” Farrell says.

Starting a new life hundreds of miles away is not a decision you want to make lightly. What is an exciting opportunity for one person could feel like a scary and daunting transition for another. But if you’re ready to take on the challenge of a new job in a new city, be sure to negotiate your relocation and compensation package for a smooth long-distance move.