Graduating is even harder than it looks.

I am one of the lucky ones who found my first job right out of school. But that secretly meant my living expenses suddenly skyrocketed after I had to buy a used car, move away from home and find and furnish an apartment.

Don’t get me wrong, I knew those purchases would be way more expensive than the usual trip to the grocery store. But there were so many details I didn’t even realize existed. It was a crash course.

Now I want to make sure that doesn’t happen to you. Here are the random expenses that hit me after graduation, plus how I survived a rocky first few months so that I remained intact before my first adult paychecks could make an impact.

1. Moving Costs More Than You’d Think (But There’s a Hack for That)

When I graduated I lived on campus, but I still somehow had a lot to move into my first apartment. The first thing I did was figure out if anyone could help me move. In return for snacks, my friends and family were happy to offer some manual labor. I got lucky!

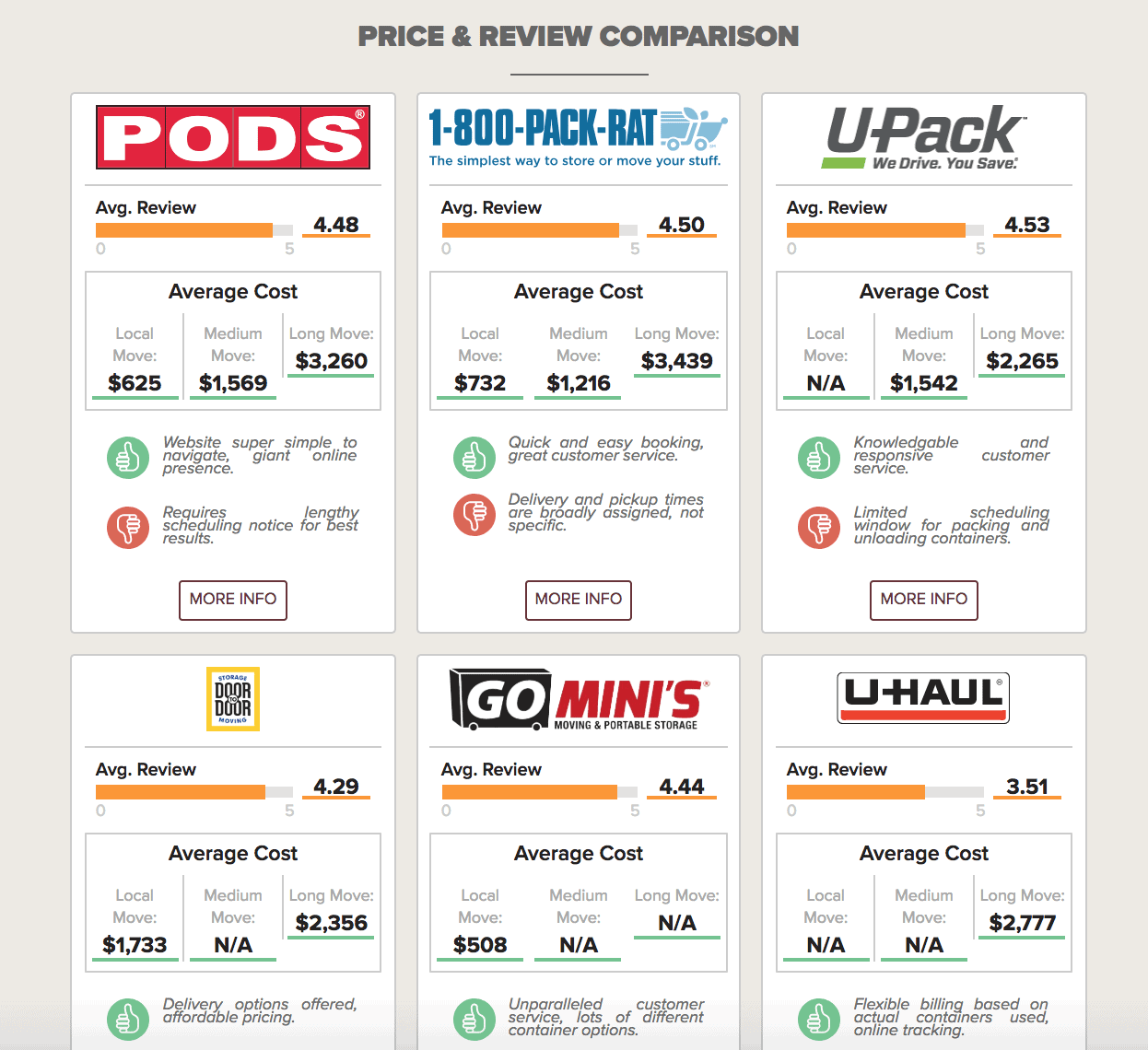

But when I got a job, it ended up being located out of state. So to save money, I figured out I could rent a truck and tow my car behind it, and only hire movers to do the lifting. Getting your own vehicle and hiring labor separately for either end of your move (Hybrid Moving) costs less than Full Service moving and varies dramatically in price, but the average cost is around $660. It’s an added cost, but plenty of critical time saved, which I needed.

HireAHelper lets you compare the price of movers and customize everything, from how many people help you move to what arrival time window you’ll need. The more options you can compare for a moving process the better, as every move is going to be a little bit different.

See prices for movers by the hour – instantly.

Read real customer reviews.

Easily book your help online.

How can someone so young take on that expense? Well, I barely had enough to cover the move, but here’s another thing I learned — many employers offer reimbursement for moving expenses! Make a note to talk with your new employer and ask if they make a similar offer. It was a lifesaver when my company helped me out so that I could put my money toward the next round of expenses!

2. Crossing State Lines Can Mean More Fees

When you move to a new state, you’re going to have to get a new state license and plate for your car. The steps will be different depending on your move, but you can check out the process for your specific state online to know what prices you’re in for.

I had to fill out paperwork and pay fees for the process of:

- Getting an updated title for my car

- Printing a new plate

- Creating a new license

All of it cost about $200! Plus, there was the time it took to go to the DMV, get my new emissions test and talk with my car insurance company about my new address and license information.

Call the DMV where you’ll be moving to ahead of time for clarification because it really is a lot to deal with when you’ve never done it before. It definitely was for me.

3. Even My Used Car Had a Major Price Tag

When I was in school, I used my parents’ old car to get around to my part-time jobs and the grocery store. But after college, I knew I had to get my own ride. I’d been saving up for a while and figured I could negotiate the price of the car down to what I had in my savings account, but it turns out there’s so much more to it than that.

The only thing I knew about buying a car before I walked into the first dealership was that you have to negotiate your final price, but fees and taxes can’t be worked down. The dealer had to explain things like document fees and dealer fees, plus the sales tax. (Again, every state will be a bit different, though some fees are the same across the board.)

It’s smart to save up some extra cash to cover these fees since they’re non-negotiable. While you’re getting your down payment together, take steps to research what these expenses will be so you can better plan for the total cost of a car.

Lastly, make sure you can handle the monthly payment. While I saved enough for a hefty down payment, I did have to take out a small loan to cover the rest. I automated my car payments through my bank once my regular paychecks started rolling in so I would never risk jeopardizing my credit score with late payments.

4. My First Student Loan Payment Shocked Me

I also began to panic when the loan bills came in. I hadn’t even earned my first paycheck with my new job yet, so how was I supposed to pay $350 a month after already paying for moving and buying a car?

That’s when I started to research how to consolidate my loans, and it really saved me. The Department of Education can consolidate multiple federal loans with one fixed interest rate, which streamlines the process and extends your repayment period. Rather than juggling multiple payments, I just had to worry about one.

You may also consider private refinancing if you’ve landed a steady job and worked to build a credit score of at least 690. This can both consolidate your loans and lower your interest rate — but isn’t necessarily always the best choice for recent grads. Do your research!

(So I Learned a Budgeting Trick)

Sure, I’d managed my own bills in college, but between forthcoming loan payments and the costs of moving and a higher rent, I saw my expenses skyrocket.

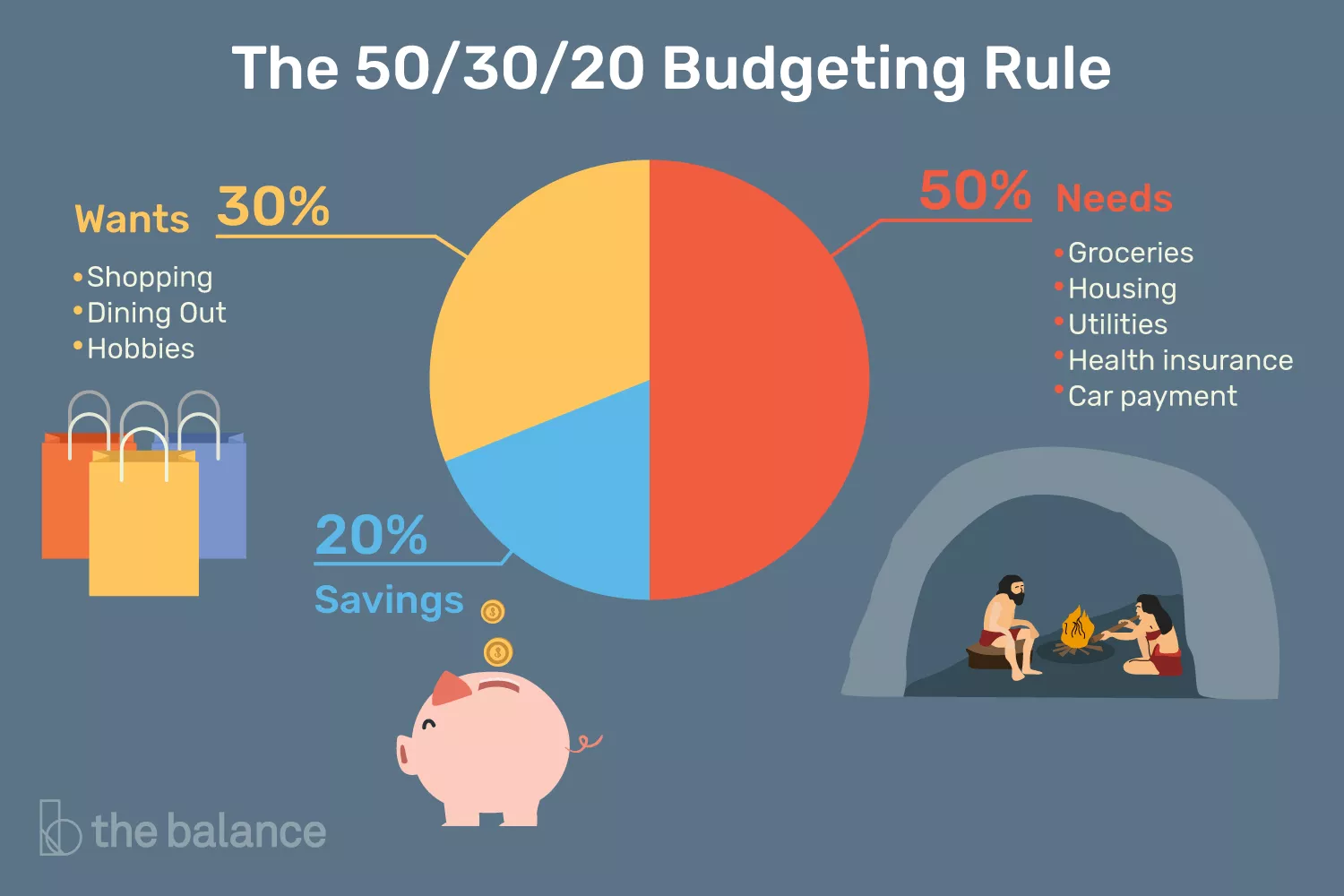

So I did some research online and began militantly tracking all of my income and expenses with a Google spreadsheet. I vowed to follow the 50/30/20 budget, which stipulates that half of my earnings pay fixed expenses, 20 percent goes to debts and savings, and 30 percent is reserved for variable expenses like groceries and light spending.

It’s tempting to have your paychecks come in and put all your extra cash toward one big thing like a savings account or credit card debt, but metering it out will help you tackle everything at once. Building my savings while decreasing my debt has helped me more in the long run than just choosing one over the other.

Now, my healthy savings account means a minor emergency like a car repair doesn’t trigger any anxiety. After upending my meager college savings to move, a steady and dependable tracking system soothed my nerves and helped me navigate this whole new world.

5. Filling Up a New Apartment Drains Your Wallet

I had to buy all my own furniture, and you can bet that I didn’t have the money to do it all at once! For a little bit, my apartment décor consisted of a mattress on the floor and the most basic kitchen supplies. A good list of basic apartment supplies you’ll need will consist of:

- Plates and bowls

- At least two or three of each type of silverware

- A trashcan

- Dish soap and a sponge

- Toilet paper

- Basic cleaning supplies (e.g., broom, cleaning solution)

Don’t panic if your apartment doesn’t feel like home for a little while. Getting more than the basics will take time, but eventually, your new fancy budget will help you get everything on your list, and your apartment will gradually feel more like a home and less like a living space.

Plus, if you have a roommate, that makes your quest to fill the space of essentials even easier! Me? I bought myself a couch from a killer Amazon Prime Day deal—and I’ve been treating myself with one apartment item a month since.

Some of the above surprise costs were never mentioned to me because I didn’t know to ask about them.

Give your post-college world about six to eight months to settle down. Now, I’m much more financially secure and living in a home that feels cozy and welcoming. I’m finally ready to put some money into my travel fund and I don’t sweat the occasional sushi dinner. For now, you just have to buckle in and prepare for a crazy ride after that diploma lands in your hand.