Key Findings

- 21% of people who moved from January through July 2021 said they moved due to COVID-19

- During the first three months of 2021, every third move was due to COVID-19

- 37% of COVID-related moves were people moving due to going remote

- One-in-five (22%) moved after selling their home in a favorable real estate market

- Around 18% moved because they didn’t feel safe where they lived

- 17% moved because they couldn’t afford their housing and had to relocate

- For the first time in years, more people moved into New York City (+51%) than left it

When we looked at how Americans moved during the pandemic at the end 2020, people reported about one-in-four moves were due to COVID. Moreover, most of those surveyed who said they moved due to COVID were driven by concerns for personal health and safety, financial hardship, and the need to take care of family.

How have things changed in the world since? Well, 2021 has been an ever-shifting landscape for moving so far.

Meanwhile, among factors directly related to public health, employers are deciding whether to go fully remote or to ask everyone to go back to the office (or go for something in-between). Elsewhere, the real estate market continues to exceed all expectations as prices climb higher than ever and homes are selling at a record pace.

Okay, so how have these recent events affected the way Americans move? To find out, we analyzed a sample of over 57,000 related moves booked through HireAHelper.com and our partners from January through July of 2021. We also surveyed these customers to understand why Americans said they moved throughout 2021.

Defying Delta: Americans Continued to Move at 2019 Rates Despite Ongoing Pandemic

During this time in 2020, overall moving came to an almost grinding halt. Likely due to a fear of infection, many opted to move by themselves, booking activity was low, and cancellations were through the roof.

As we found out through the data later, many moves simply ended up being postponed for later in the year when it was safer. Towards the end of 2020, the overall number of yearly moves actually evened out as the busy summer “moving season” shifted towards the end of the year.

In 2021, we have a different story on our hands. As the number of newly discovered COVID cases dropped, the number of moves grew at a slow but steady pace. Then, as national vaccinations began to pick up the pace, so did the moves. By April-May 2021, many more Americans were moving than the year previous.

This trend continued into the summer months, despite the surge of the Delta variant, otherwise known as the latest variant of the coronavirus which became the dominant strain in the U.S. in early July.

Whether due to the proliferation of the vaccines, the unwillingness to postpone moving plans any longer, or just harsh economic realities, Americans seem to be moving much more actively in 2021 so far.

Get Help Unloading Your Rental Truck

See prices for movers by the hour—instantly.

Read real customer reviews.

Easily book your help online.

Remote Work, Real Estate, Return to Safety: Why Americans Said They Moved in 2021

As noted at the top of the article, 21% of moves made by our customers in 2021 were due to COVID-19, and more specifically the Delta variant.

That’s somewhat down from 25% at the end of last year, but still higher than the 15% of moves forced by the COVID pandemic we saw in early 2020.

Apart from being fewer in number, other things different about this year’s COVID-related moves are the reasons behind them.

In mid-2020, people who moved because of COVID claimed they did so out of financial hardship, to be closer to family, or due to feeling unsafe where they lived. By the end of 2020, the top reasons were similar: feeling unsafe, loss of job or income due to COVID, taking care of family.

“Financial hardship and concerns for safety gave way to remote work (37%) and taking advantage of the housing market by selling a home (22%) as the top COVID-related reasons to move in 2021.”

This year, however, things changed. Financial hardship and concerns for safety gave way to remote work (37%) and taking advantage of the housing market by selling a home (22%) as the top COVID-related reasons to move in 2021.

This isn’t to say that concerns for health and safety are completely gone. Almost all COVID-related moves still happen for those very reasons, but the shift is clear. In 2020, pandemic-related moves were about sheltering in place to adapt to the new reality. In 2021, Americans seem to be making the most of the opportunities the pandemic presented despite all the hardship it brought about.

The Change of Reasons: Covid-related Reasons for Moving Throughout the Year

Sure, across seven months, many people moved to work remotely or after selling their homes in the booming real estate market. But that’s not always been the case in 2021. Let’s look at the most common COVID-related reasons for moving in 2021, over time.

Feeling unsafe due to COVID spread held at 10% of all pandemic-affected moves for five months, dipping to as low as 5% in June. But then the Delta variant happened. By July, as many as 15% of all pandemic-related moves were people concerned for their safety from the rapidly spreading infection.

Moving to work remotely is the reason that only became more common as the months went by, accounting for roughly 20% of all COVID-related moves in 2021. Selling a home peaked in May-June time, when this reason contributed to 15% of all COVID-related moves.

One reason that became less and less common as the year 2021 went on is moving due to losing jobs and income to COVID. Last year, as many as 35% of moves forced by the pandemic were down to financial hardship. In July 2021, financial hardship only accounted for 8% of stated reasons for a move.

Back to the Office? New York City Had More People Move in Than Out for the First Time in Years

We’ll leave the traditional review of where people are moving to and from for our annual report, but there was one curious finding that emerged from our analysis of moves in 2021 thus far.

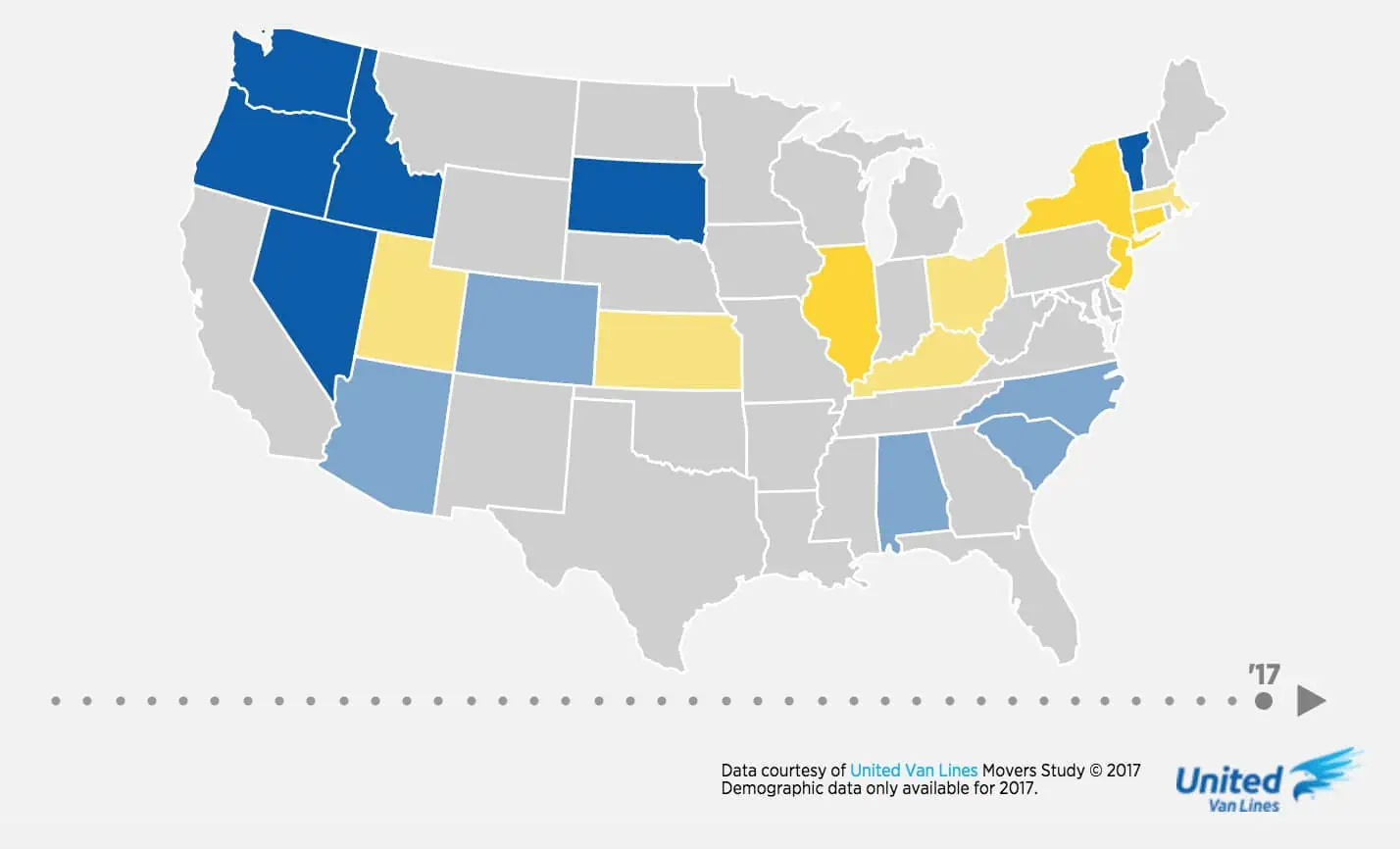

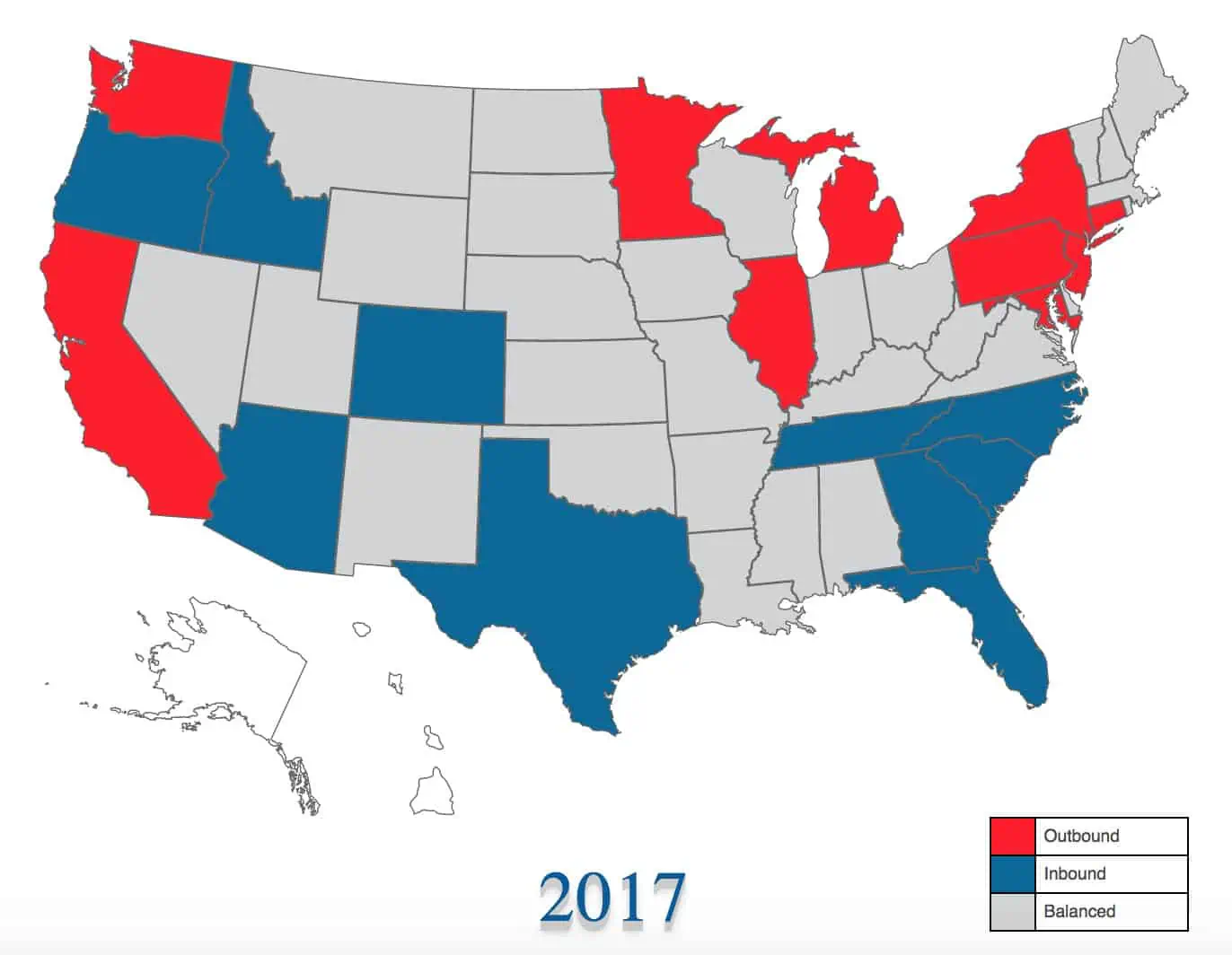

According to the data, reports in the media, and figures from other companies in the moving industry, one trend always shines through; when you look at America’s biggest cities, such as New York, Chicago, Los Angeles, San Francisco, more people typically leave them than move in.

This has been true for years, but now we may have an exception on our hands. 51% more people moved to New York City than left New York City in the first seven months of 2021.

In fairness, except for NYC, all the other major U.S. cities are showing the same trend they have in recent years—more people are leaving them than moving in.

Whether this is a sign of an impending “big return to the office”, an indication that people started feeling safer, or a blip in the data remains to be seen. (We’ll round up all the moving trends in our annual report, likely to be published in January 2022.)

Return to Normal? Moving in 2021 Looks More Like It Did Before the Pandemic

Not only are people actively moving again, how and when they’re doing it resembles pre-pandemic patterns more than it does last year’s trends.

Take when people move, for example. In 2020, due to the spread of COVID-19, many people were forced to either cancel or postpone their move. This is why we saw 30% fewer people moving during “peak moving season” of May-July and 30% more in September-October time.

That’s not what 2021 looks like so far. If we look at when people moved this year and compare it to the last two years, we’ll see that the 2021 curve resembles 2019 a lot more than it does 2020.

Another indication that moving in 2021 looks a lot more like 2019 than 2020 is how big the moves are again.

In 2020, likely due to many moves headed towards temporary, smaller accommodation, the size of an average move stood at 1,595 square feet, down by 282 square feet from 2019.

But in 2021, the moves are big again—bigger than 2019 in fact. A typical move so far in 2021 was 1,793 square feet.

Based on the data, it looks like despite the surge of the Delta variant (or possibly in tandem with it), Americans moved in larger numbers in 2021 than in 2020 thus far.

As coronavirus continues to mutate and the overall vaccination pace slows, it’s impossible to predict what’s going to happen in the coming months. Whether moves will continue unimpeded or we’ll be forced to slow down and shelter-in-place again remains to be seen.

One thing we know for certain is that protecting your health and safety is still critically important when moving. If you are thinking of moving, be sure to check out our guides to moving during the pandemic and when states reopen to make sure your move goes safely, as well as smoothly.