Illinois is an interesting place. It is home to the nation’s third largest city, yet almost 80% of it is farmland. Nicknamed the Land of Lincoln, Abraham Lincoln was not actually born there. At 1,235 feet above sea level, Charles Mound is the state’s highest natural point. But the top floor Skydeck of Chicago’s Willis Tower sits at 1,354 feet, making it the highest place to put your shoes in all of Illinois.

The laws of Illinois are no less intriguing. Whether it’s something as basic as beer or unusual as an authentic cane sword, Illinois makes it clear that they aren’t fooling around when it comes to what you can bring with you when you move in (although, we have yet to find a statute that makes it clear whether you can import your pet elephant).

We’ve done the legwork so you can get your questions answered, and roll with confidence into the Prairie State.

Alcohol

Both fun-filled road trips and the laborious task of moving can elicit thoughts of downing an ice-cold beer. But as you prepare to hit the road, think twice about packing those cans for your new place.

“…Illinois [is] contending with an ongoing pest problem, [and] does not allow firewood to be carried out of state, and strongly recommends burning firewood where it was found or purchased.”

According to the Illinois Administrative Code, Title 11, § 100.480 – Importation of Alcoholic Liquor (b):

A person is permitted to import alcoholic liquor into this State for his or her personal and non-commercial use without first obtaining a license to import if:

- The total volume to be imported per year is less than one gallon; or

- You acquiesce to a mess of conditions and cumbersome paperwork that basically makes it too much of a pain to even bother. (We’re paraphrasing here, but it’s close enough.)

In short, leave your barrels of beer behind with your friends when you say goodbye.

Open containers prohibited

A note to anyone riding in your rental truck with you: According to Illinois law:

“No driver or passenger may transport, carry, possess, or have any alcoholic liquor within the passenger area of any motor vehicle upon a highway in this State except in the original container and with the seal unbroken”.

So not only do you have to ride under that one-gallon limit, but you have to make sure every bottle or can you’re taking with you hasn’t been opened at all.

Animals and Pets

Dogs & cats

Bring Fido and your feline along, but get them checked out at home first. You’ll need some paperwork from a vet that has the necessary information about your pets to get them across state lines.

As stated on the Illinois Department of Agriculture website, the requirements for all dogs and cats are:

- Every pet must have a Certificate of Veterinary Inspection (CVI) issued within 30 days of entry showing the age, sex, breed, and description of each animal, and also provide a complete destination name and address within Illinois.

- The animals being transported can’t be sick during the trip, or originate from an area under rabies quarantine.

- All dogs and cats have to be at least 16 weeks old.

- They must be vaccinated against rabies, and the date of vaccination and manufacturer information needs to be included on the CVI.

Livestock

The animals that fall under this umbrella are typically cows, horses, goats, llamas, alpacas, and pigs. Unless you’re moving a herd of livestock into Illinois for slaughter or grazing purposes, these animals need to be accompanied by a CVI and something called an entry permit.

“…[T]here is a 60-day grace period for obtaining your Firearm Owner Identification Card (FOID), required for all gun-owning Illinois residents. This begins when you receive your Illinois driver’s license or Illinois State identification card…”

Entry permits typically list the number of animals being moved, the name and address of a consignor, and the name and Illinois address of the consignee. Livestock also has a longer list of possible illnesses and diseases they need to be checked for compared to pets. You can find a complete list of the requirements for various livestock, as well as the form for entry permits, on the Illinois Department of Agriculture website.

“Dangerous animals” & primates

Illinois law expressly states that you, unfortunately, must leave your leopard behind. In addition, individuals in or entering Illinois may not have in their possession any “dangerous animals”, which basically means any wild cats, bears, hyenas, wolves, or coyotes. Primates are illegal to possess as well.

Of course, there are many more species of animal that will more than raise a few eyebrows at the border. Among those listed here are European rabbits, Java sparrows, and walking catfish. Not listed are pandas, porcupines, and baby rhinos, so you’ll need to practice your own good judgment there.

Here’s a fairly comprehensive list of animals that are illegal to own (scroll down to Illinois).

See prices for local moving labor. Read real customer reviews. Easily book your help online.

Fish & aquatic life

Bringing your fish tank to Illinois? The list of approved aquatic species is long, including all sorts of snails, shellfish, and aquatic plants. Just be sure to know the names of your watery pets — no, not “Swimmy,” but the formal and/or scientific names.

Not surprisingly, goldfish are listed. Surprisingly, angelfish are not. While we suspect you and your heavenly swimmer will be waved through border control, if you have any questions, concerns, or doubts, all the contact numbers you could need are right here.

Guns, Weapons, and Fireworks

What types of guns are legal

In January 2023, the State of Illinois passed a new and comprehensive guns and firearms law, making the Land of Lincoln the 9th state to ban assault weapons, in addition to making the sale and distribution of many automatic and semi-automatic firearms and accessories illegal.

Safe firearm transportation

Basically, if you have a permit from your state of origin, you can bring your gun into Illinois provided it is being transported legally. That means your gun and ammo are separate, locked, and out of reach. For all the details you may need, check out this brochure regarding the safe and legal transport of guns into and throughout Illinois.

Firearm permits

If you are moving to Illinois with your gun, know that there is a 60-day grace period for obtaining your Firearm Owner Identification Card (FOID), required for all gun-owning Illinois residents. This begins when you receive your Illinois driver’s license or Illinois State identification card, which you must obtain within 90 days of taking up residence in the state.

For information on obtaining your FOID card, check the Illinois State Police Firearm Services Bureau (ISPFSB) website. Additional information on concealed carry and other firearms laws can be found here.

See prices for local moving labor. Read real customer reviews. Easily book your help online.

Knives & other weapons

All automatic blades (i.e., switchblades), folding blades (i.e., pocket knives), and fixed-blade knives with a blade longer than three inches are all illegal to own or carry, and so are ballistic knives, throwing stars, and brass/metal knuckles. Stun guns and taser guns and, potentially, broken bottles, are all illegal as well.

Fireworks

In many states surrounding Illinois, fireworks are plentiful and plenty legal. However, inside Illinois, almost every flavor of firework is illegal, even when bought in one of those neighboring states. A few types of non-exploding pyrotechnic fun are legal: sparklers and snake pellets to name two. But most everything else is a no-no, including on the Fourth of July.

Plants and Produce

Illinois boasts over 72,000 farms operating over 26 million acres of farmland. The state is the country’s #1 producer of pumpkins, and is 3rd in the nation in farmer’s markets. So it makes sense they’d be protective of their agricultural health.

What makes adhering to laws on prohibited plants and produce difficult is the lack of any hard and specific list of what’s actually prohibited. The state government simply says that “if there’s a problem anywhere, the state can prohibit the importation into the state of any plant material from that area.”

“A 12-pack of beer will put you over the one-gallon limit. To enter Illinois legally, you’ll have to get rid of two of those cans.”

Barring any sort of known or special issue with any particular plant, there seem to be few restrictions on transporting house plants and fruits and vegetables into Illinois. If you have any specific questions contact the Illinois Department of Agriculture directly.

Firewood

Interestingly, firewood is one item that has long been restricted throughout Illinois. Specifically, the importation of untreated firewood is prohibited, and any firewood one would endeavor to bring into Illinois must have that wood certified and labeled in advance. So really, why bother? Illinois has firewood.

As an aside, Illinois itself is contending with an ongoing pest problem, does not allow firewood to be carried out of state, and strongly recommends burning firewood where it was found or purchased.

See prices for local moving labor. Read real customer reviews. Easily book your help online.

Marijuana

Illinois legalized the recreational use of marijuana in 2020, with plenty of regulations to go along with it. Here’s a rundown of the laws and penalties related to marijuana and other substances, along with the serious concept of “intent to deliver”.

But this only applies once you are in the state. Marijuana remains illegal under federal law. This means you can get in a lot of hot water if you transport marijuana across state lines. So leave your bud behind when you say goodbye and hit the road for your new home in Illinois.

Outside of big-city Chicago, in between all those farmer’s markets out among the vast Illinois farmlands, the Illinois Department of Natural Resources maintains almost 150 State Parks offering an array of recreational pursuits throughout the four seasons. Make sure you can get out and start enjoying it all as soon as possible by knowing ahead of time what you can and cannot bring into the state and cruise hassle-free across the state lines into your new home.

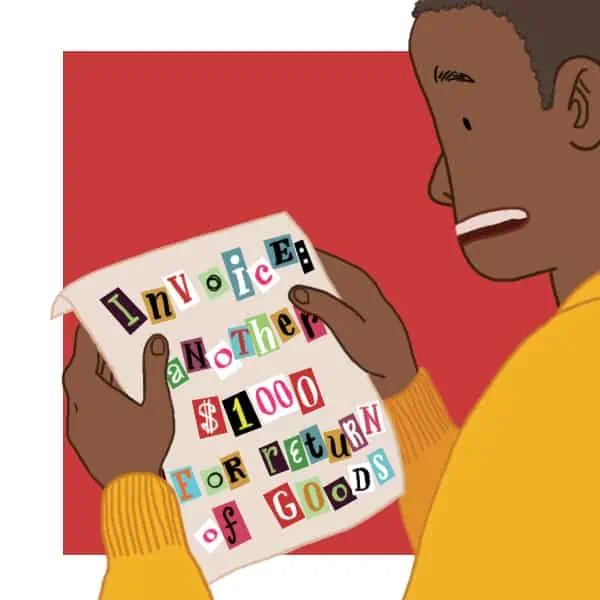

In the past, there was not much local law enforcement could do in disputes between moving companies and customers due to the fact such disputes are civil and not yet criminal matters. But recent changes in some states’ laws have given those local authorities the power to mediate; In particular, some laws now intervene when a moving company is sitting outside a customer’s home demanding more money before they unload.

In the past, there was not much local law enforcement could do in disputes between moving companies and customers due to the fact such disputes are civil and not yet criminal matters. But recent changes in some states’ laws have given those local authorities the power to mediate; In particular, some laws now intervene when a moving company is sitting outside a customer’s home demanding more money before they unload.

More often than not, whenever we do hear of a customer finally getting their belongings delivered it was because they sought the help of a local news station.

More often than not, whenever we do hear of a customer finally getting their belongings delivered it was because they sought the help of a local news station.

Tax laws can be complicated, so make sure to do some research to determine whether you should file

Tax laws can be complicated, so make sure to do some research to determine whether you should file  Finally,

Finally,